Have you wondered why a well-structured PPC strategy is so crucial for your Amazon performance?

You will find the answer in one of our clients’ incredible, just-starting journey. In only 2 months, we transformed the brand from burning money needlessly to a stable and growing Amazon player!

Let’s start with the basics.

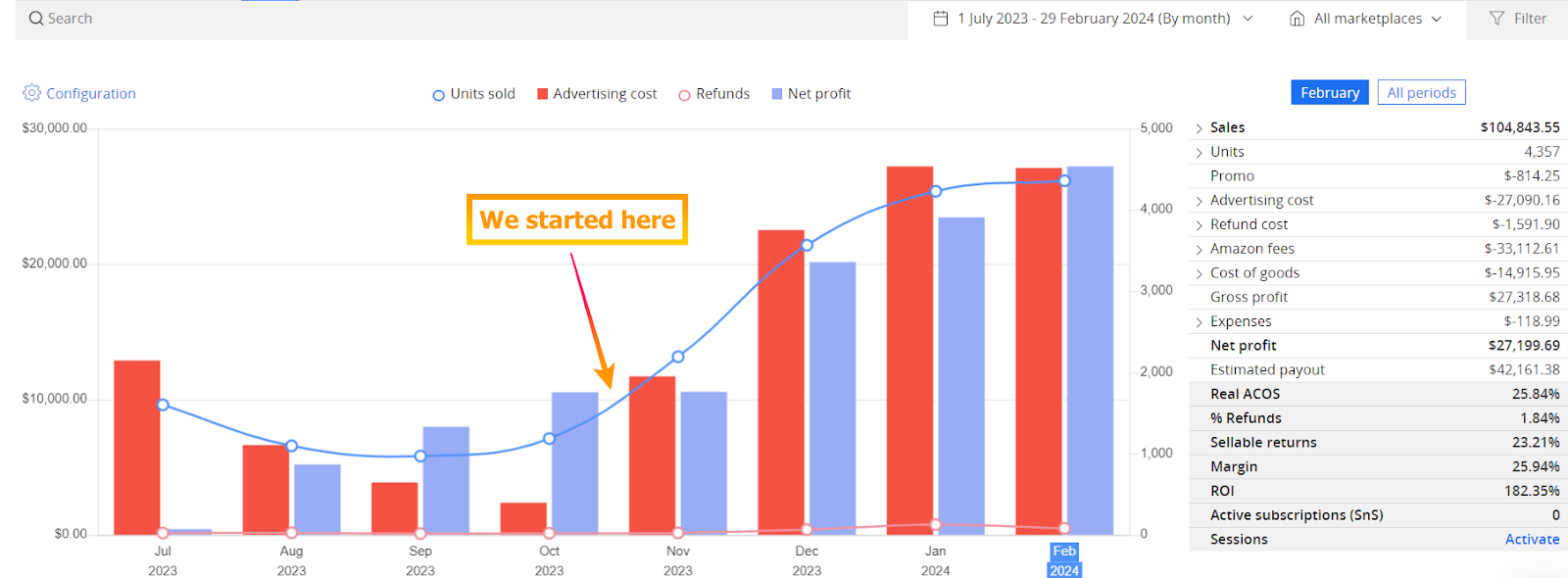

We started working with this business in the middle of October 2023. The client has been selling on Amazon for nearly 3 years, but the brand wasn’t performing very well. The client’s team spent a lot of money on advertising, but the sales weren’t enough to create positive results.

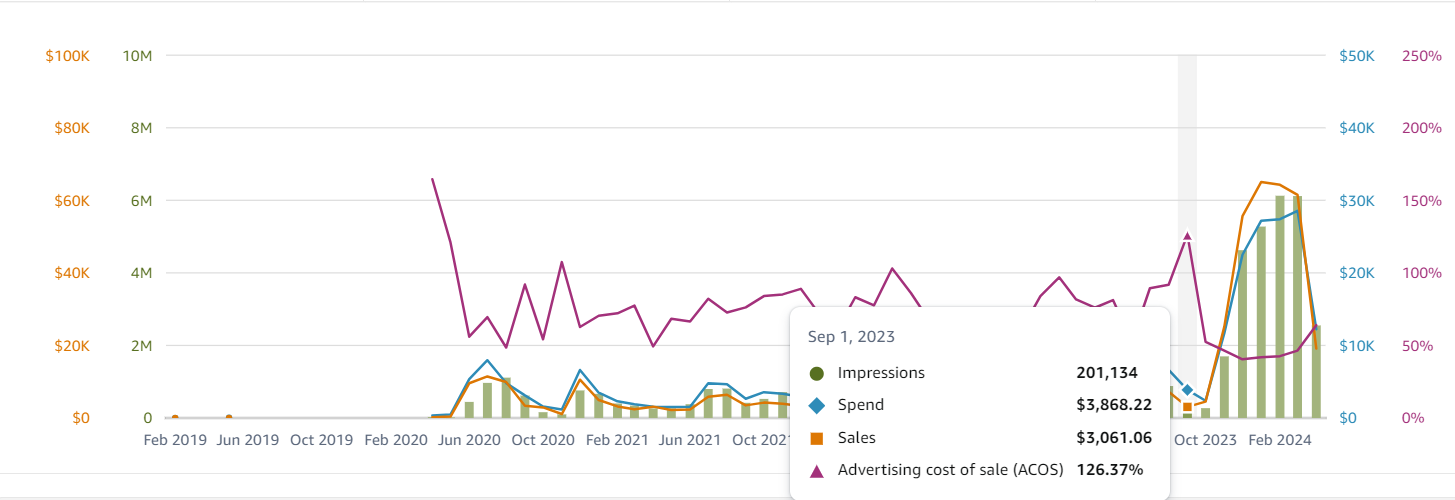

Even though the brand was working with advertising software, the ACoS was very high – 126% on September 1st., 2023.

You might wonder how this business has survived with these numbers.

The answer is in the first and most important product essential – uniqueness. The product is so good that even with a “bad PPC strategy”, it was profitable and kept the brand in the game.

What did we do when we took the heavy lifting?

In October, we made a full account audit of the business. Besides the poorly structured PPC advertising, the Product Detailed Pages of the brand had underoptimized listing copies, low to medium-quality infographics, and A+ content.

We started optimizing the account from A to Z:

This was one of the rare cases where the A++ content didn’t have much impact on growing the account.

When we adjusted the advertising strategy and focused on keyword targeting and winning positions on the search results, we started seeing the difference in organic ranking, thus improvement in sales, ACoS, and profit.

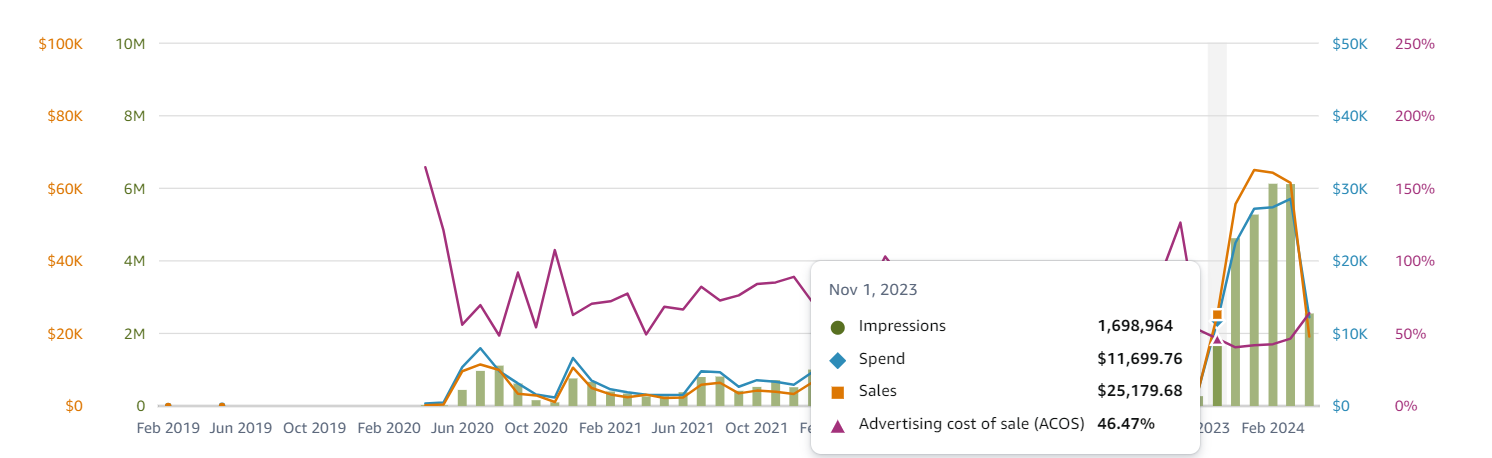

In November 2023, we decreased our ACoS from over 100% to 46%, and the profit margin was over 21%.

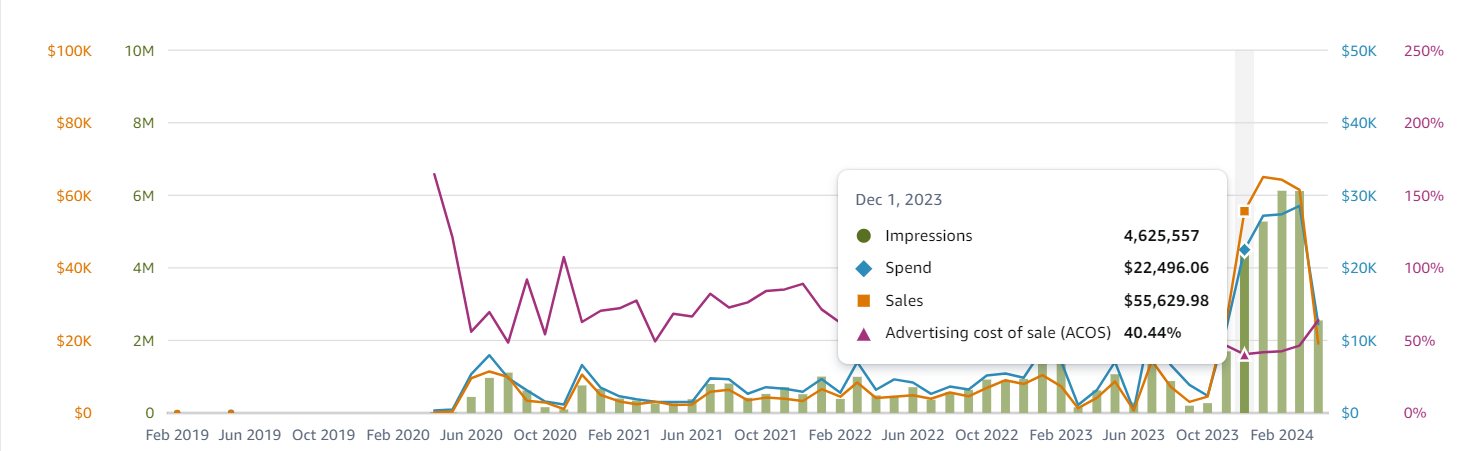

In December, our ACoS dropped to 40%, and our profit margin was over 23%.

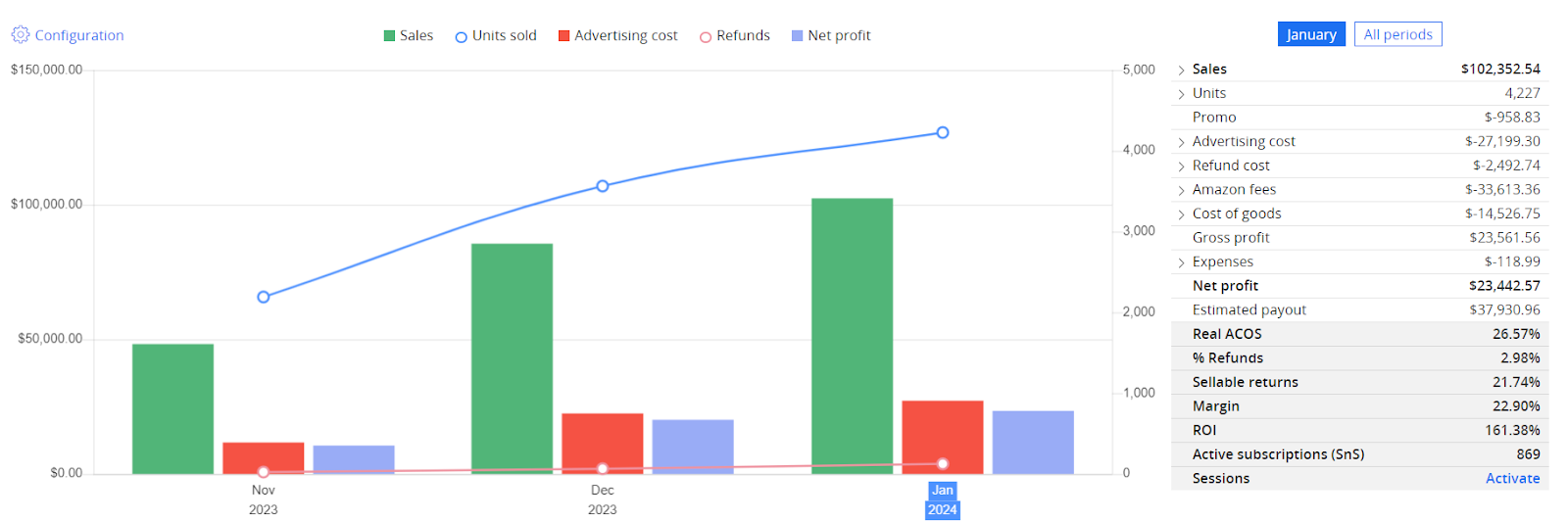

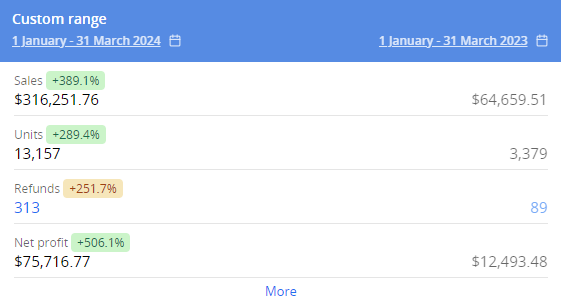

We thought we reached our best performance for the winter season, but we were wrong. This is not a seasonal product. In January 2024, we hit over $ 100,000 in sales with a 23% profit margin and 42% ACoS.

In January and February, we managed to stabilize the account and keep steady ACoS levels and profit margins, even though we heavily increased ad spend over the first months of working together. We have reached a new status quo.

At the moment, the brand is in the Growth phase, and we will keep this stage for at least a year.

Our goal is to use the market at its maximum – to push KW targeting, climb up in search results as high as we can, and of course, to generate as much revenue as profitably as possible.

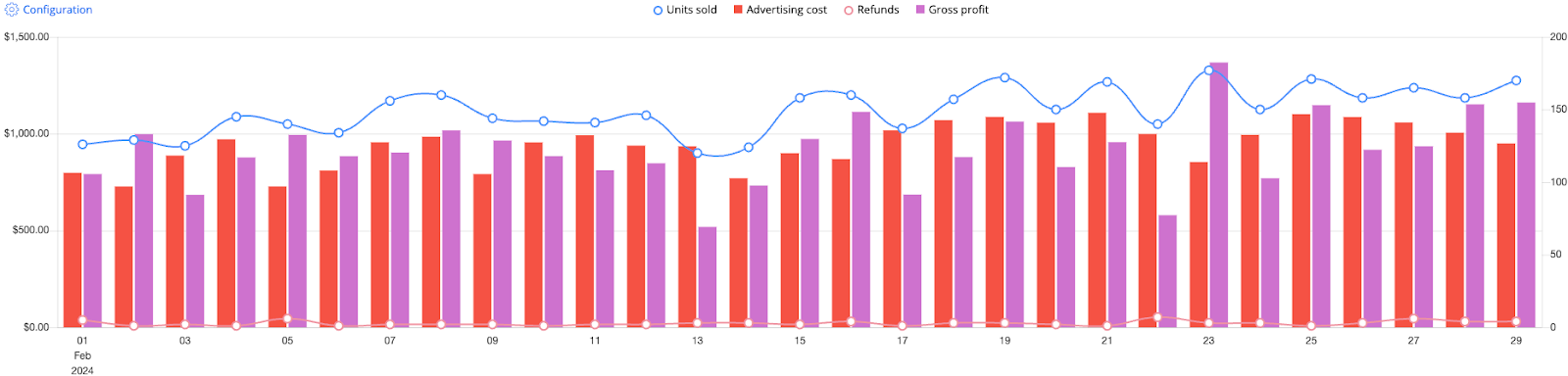

February was proof that this brand has the potential to reach its goal and much more.

We registered new records and tested different strategies. They led us to over $ 104,000 in revenue and an average of 25% profit margin. We even increased that number to 33% on February 23rd. On this day, we registered over $ 4,000 in daily sales.

Our goal is to keep this level of revenue for at least a couple of months. This way, the client can reorganize their cash flow and avoid running out of stock – one of the biggest problems for the accounts we work with.

Another key factor for the initial growth of the brand and the February results was the fact we focused on relocating the ad spend from our best-selling products to secondary items experiencing growth.

Thanks to this move, we finished February with a 2x increase in sales for some of them, and we know this is a successful move for the brand.

Another strategy we tested in February was changing the main images for some of the secondary products. The factor that helped us was the small banner we added mentioning the product’s key advantage.

Our strategy to focus on secondary products and optimize main images led us to a peak in impressions. Compared to January, when we had 5.2 million impressions, they increased by 10% in February, and we finished the month with 6 million impressions.

Regardless of new strategies and tests, we manage to maintain a stable account margin of over 25% and ACoS below 44%.

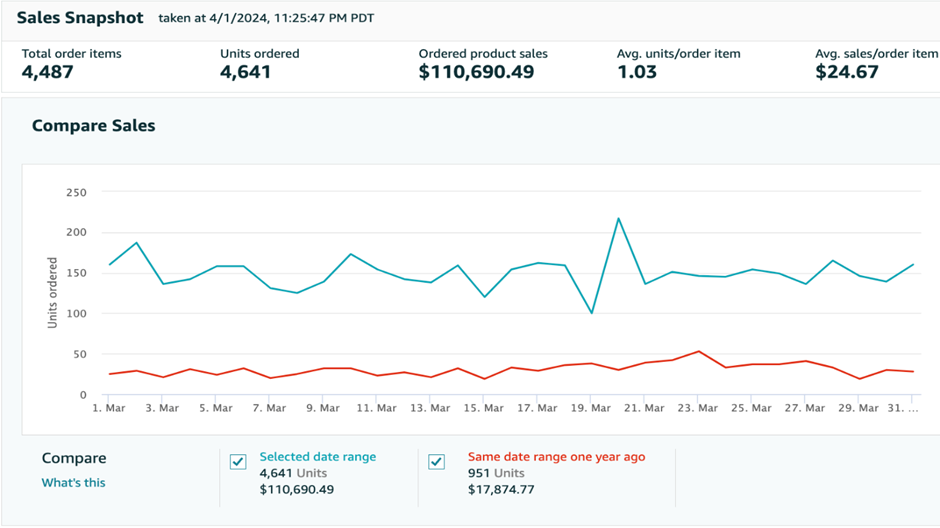

March was very intensive.

We experienced some great successes.

As I mentioned above, the secondary products were our main focus for the last month of Q1. Although we increased advertising spend for multiple products by 4% compared to February, we also boosted sales velocity and managed to maintain a healthy profit margin of 24%-25%.

Our sales growth performance surpassed that of February, and March was another record-breaking month, amounting to $110,690.49 in revenue, reflecting a 6% increase in sales.

The next step in our strategy was to test Lightning deals.

The results weren’t as good as we expected as we sold only 50 units of our main best-seller product and several units from the secondary products we were focusing on. However, we received valuable data for the products.

In March we were excited to launch a new product and here came one of the biggest issues we faced. Right after the launch, we lost the buy-box.

This is where we faced our first issue.

The product launch and advertising ran correctly, but after just 2 sold units, Amazon revoked the buy-box from the listing.

Even though we didn’t have the buy-box back, we set up a VINE program for these products, and the first reviews have started coming in.

In addition, we’ve experienced a couple of instances of stock shortages on several products. Therefore, it is essential to maintain healthy stock levels, especially for products with aggressive advertising approaches.

Running out of stock is very dangerous for your brand’s growth and performance. It affects your rankings, rendering all your advertising investments useless and causing you to lose your organic and sponsored positions. Amazon now also charges sellers additional fees for low stock levels.

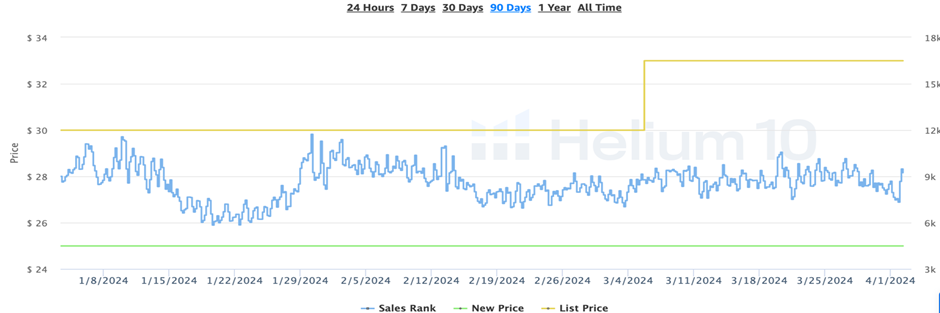

Throughout March, we analyzed our main KWs search volume and the performance of our main variation over the past 90 days. The data showed a consistent, gradual decrease in searches and performance from the middle of February to the end of March. A low seasonality may have begun for this product.

Regardless we increased ad spend on our secondary products by over 65%, at the beginning of the month, and in the following week, ad spend was optimized. The significant decrease in search volume also contributed to the overall decrease in ad spend.

Our goal in 2024 is to maintain the new revenue levels with incremental growth, so the client can effectively organize their cash flow and manufacturing.

As our products progress through their lifecycle, we will be able to lower our TACoS (currently at ~26%) by a big margin, thus when the products reach the “Cash-Cow phase” they will be much more profitable

Although we are at the beginning of this brand’s Amazon journey, we know the best for this client is yet to come.

Don’t miss our next update, and don’t forget to comment “audit” for a complimentary account review. Your Private Label brand will thank you.

AMZ Bees is an e-commerce agency that grows and manages brands on Amazon with advanced PPC strategy, listing conversion optimisation and problem solving.

© Copyright 2021 AMZBees.com. All Rights Reserved